🏡 Gwinnett’s Affordable Housing Puzzle: From Grants to Ground Level

(June Series: Part 3): A look at federal programs, local implementation, and taxpayer costs behind Gwinnett’s housing assistance initiative

We hope you’ve followed along in our June series as we pull back the curtain on the inner workings of our Gwinnett County government.

So far, Part 1 highlighted our past, present, and projected population growth. Part 2 focused on homelessness and the housing insecure in Gwinnett with the statewide and county-documented homeless, sheltered, and unsheltered Point-In-Time (PIT) counts.

In today’s Part 3 post, we will highlight another key and intentional talking point of the Board of Commissioners’ Democrat Chairwoman, Hendrickson, and other county and local officials:

Affordable Housing

What Are the Various Programs❓

What does this actually look like in Gwinnett?

How much of our county falls under these programs?

To be honest—whether intentional or unintentional—researching the Affordable Housing conversation is vast, convoluted, and clear as mud!

It seems like many have their hands in the federal grant money pot… and it looks a little like this:

🏠 What Does Affordable Housing “Mean”?

It depends on how you break it down. It’s not as simple as it might seem.

By definition, affordable housing refers to housing that costs no more than 30% of a household’s income, including rent or mortgage, utilities, and related expenses.

According to the U.S. Census, USA Facts, Data USA, and others, Gwinnett County’s median household income in 2023 was $84,827. With an average 3% annual cost of living increase, we estimate the 2025 figure at around $89,917. In simple terms, half of Gwinnett households earn more, and half earn less.

Neilsberg Research reported the following as of December 2023:⬇️

The U.S. Bureau of Labor Statistics gives us another perspective at a national level:⬇️

The Federal Reserve Bank of St. Louis offers this custom resource for Gwinnett County with vital statistics:⬇️

Looking a little deeper, below offers statistics on the current unemployment trend in Gwinnett County as of May 28, 2025, showing positive declines at pre-COVID levels.⬇️

These resources are helpful to understand a broad picture of Gwinnett’s household median income breakdown and unemployment statistics.

❓Are our county and city governments planning, budgeting, and offering narratives like we’re still in the COVID era, or are they budgeting based on current facts and data?

What Do “Affordable Housing” Programs Look Like?

Many programs are offered under the “affordable housing” umbrella and fall under the U.S. Department of Housing and Urban Development (HUD) providing federal grant funding through states, and in some cases, directly to counties. Gwinnett—along with other highly populated counties— is considered an “Entitlement Program” county. If you didn’t already know, Gwinnett County is now considered an “urban” county. This means the federal grant funds can be distributed and managed by the county instead of through the Georgia Department of Community Affairs.

Here’s a breakdown of a few key HUD-funded programs:

Community Development Block Grant Award (CDBG) - Provides flexible funding to address community development needs, including affordable housing, infrastructure, economic development, and public services. At least 70% of funds must benefit low- and moderate-income persons

HOME Investment Partnership Award (HOME) - Provides block grants for housing activities, including homebuyer assistance, rental assistance, new construction, rehabilitation, site acquisition, and administrative costs.

Homestretch Program - First-time applicants are eligible to receive up to $10,000 of down payment assistance on a home located in the Gwinnett County area that is up to $349,000 for previously constructed homes and $410,000 for new construction homes. This assistance is provided as a 0% interest, zero-payment, five-year deferred payment loan. As long as the homeowner remains the primary resident through the maturity date of the security deed, the lien is canceled and no payments are required. Beginning on the first anniversary date of the security deed, the principal will be reduced by 20% each year. Individuals that have not owned property in three years qualify as first-time applicants.

Emergency Solutions Grant Awards (ESG) - Supports homelessness prevention and assistance through five components: street outreach, emergency shelter, homelessness prevention, rapid re-housing, and Homeless Management Information System (HMIS) activities.

Continum of Care (CoC) Program - Funds permanent housing, transitional housing, supportive services, and HMIS to address homelessness. Promotes coordinated community-based strategies.

Healthy Home Protection Grant Program - Funds efforts to identify and mitigate health and safety hazards in homes, particularly for low-income families with children, focusing on issues like lead-based paint and other environmental hazards.

Homeowner Rehabilitation Program - Funds essential repairs such as electrical, roof, plumbing, HVAC, enviromental mitigation.

The Housing Choice Voucher Program (HCB), also known as Section 8 – Provides portable rent/utility subsidized “vouchers” to tenant and paid directly private-owner landlords.

These are just a few highlights of the many programs offered through HUD or county initiatives.

🏘️ How It Works

For this post, we’ll focus on two main types of assistance:

Community-Based Assistance (subsidy stays with the property)

Tenant-Based Assistance (subsidy stays with the tenant)

Community-based Assistance

This category mainly covers multi-family apartment or townhome communities throughout the county that offer affordable housing rental assistance. These properties have agreed—or contracted—to a specific percentage of their units to be “rent capped” at approved lower rental rates. Often, these properties have received lower interest rates for development, deferred or lowered property taxes for a time period, and other incentives in return for offering “rent cap” units. These properties commit to sometimes 20–30 years to hold these units.

As you can see, Gwinnett County has an (over)abundance of total apartment communities—with seemingly one on every street corner.

While there is no way to know in detail how many apartment communities participate in the “rent cap” program or how many units are allocated, the Georgia Department of Community Affairs lists 181 properties in Gwinnett County (each with a designated number of program units).

An example of an agreement between the property developer/owner and Gwinnett County might look like this one (of many throughout the years) agreements:⬇️

Tenant-Based Assistance

The Housing Choice Voucher (HCV) Program (also known as Section 8) offers mixed-income apartment or townhome communities and single-family home neighborhoods owned and operated by private property owners who have registered to participate with the Georgia Department of Community Affairs. This allows a potential renter to select their desired county/city of choice. Once a rental agreement is signed (must be at least one year with a security deposit) with the rental landlord, the tenant pays 30% of their income toward rent and utilities, while the landlord receives the assistance payment (voucher) directly from the program.

In the Atlanta HCV program, you must live within the city of Atlanta for the first year. After the first year, you can move anywhere in the U.S. where there is an HCV program as long as you are compliant with program requirements.

To be eligible for a Housing Choice Voucher, you must:

Be a U.S. citizen or have eligible immigration status.

Meet the definition of a family (one or more individuals who live together set by HUD.

Meet income requirements set by HUD

Pass a criminal background check.

Be 18 years of age, or older.

Have a valid social security card.

Again, there’s no way to fully understand how many private property owners in Gwinnett County choose to participate in HCV. However, through research and Open Records Requests, we know the following landlords, real estate groups, and private corporations participate in this program—(ex: Global Reach Properties located in MA, Lawrenceville Leased Housing Associates III, LLLP, Permit Me Management, LLC, National Home Buyers, LLC, Renters Warehouse Georgia LLC out of MN). These entities are likely acquiring or already own multiple properties in Gwinnett specifically for this purpose. Notably, many of these landlords and property owners operate from outside the county—or even out of state.

NOTE: Although full contact information was provided through open records, we have redacted contact information for privacy.

To see the full list of all 674 participants:⬇️

What Might a Rental “Voucher” Benefit Look Like?

For some reason, seeking this information is akin to asking for the Presidential nuclear codes and seemingly held tightly by departments. Open Records Requests have gone unlawfully unanswered, or the information is “skirted” around in requests. Why? As taxpayers, this information should be transparent and easily accessible to the general public.

Through independent research, we were able to locate the following HCV payment structure and allowances for tenant-furnished utilities and other services:

🔗To see all 2025 utility payment options available: HUD Utility Payment Options

We’ve all seen news reports over the past several years highlighting how independent middle- to lower-income earners, single-parent households, and long-term renters—many with no history of issues and a record of paying rent on time—are suddenly not renewed or given notice to vacate. As a result, they’re displaced into an increasingly competitive and limited low-rental inventory. Many of these formerly independent rental units have since become HCV properties, further limiting options for those seeking reasonably priced rentals outside the system.

In interviewing landlords who participate in the HCV program, they stated a simple fact: Many private rental property landlords are in it “to make a profit.” According to these sources:

“Many realize they can ultimately make a larger profit margin on their monthly rent by participating in the voucher program.” Further stating, “The payments come directly from the state and are guaranteed, making ‘chasing rent payments’ a non-issue and appealing.”

They also indicated that:

“At one time or another over the years, all have felt they’ve had tenants possibly earning more than the program allows and potentially taking advantage of the system.” They all recounted personal stories that led them to that perception.

Moreover, at the current Gwinnett County approximate $89,000 AMI, a single income earner of around $62,000 could technically qualify for these programs.

In a conversation with a current HUD employee, this very topic came up. I asked, “Why wouldn’t many young graduates or early income earners just take advantage of this program?” He responded candidly: “Technically, they could as long as you qualify.”

We discussed the unintended fallout of COVID, when many restaurant servers and service industry workers in Atlanta lost their income due to mandated closures. In response, many turned to federal housing programs for support—a move that was completely understandable during a time of crisis and emergency.

I asked a follow-up question: “Are many of these same recipients still in the program today, even though the industry has largely returned to pre-COVID levels?”

His response: “Likely, if they still qualify.”

He went on to share his own story from years ago, when he had just graduated college. Starting out as a new, lower-range income earner, he attempted to apply for assistance but discovered he was just a few dollars over the income threshold. In an effort to qualify, he approached his employer and asked if they would reduce his pay to meet the program requirements. They refused.

He did indicate the program requires annual reviews of participants’ incomes for renewal verification. However, this is often left to the “Entitlement” counties or pass-through grant recipient NGOs to conduct these follow-up reviews.

Who Manages the Gwinnett County Programs?

The Housing and Community Development Division Office (under the leadership of the Gwinnett County Department of Financial Services) is the lead agency that administers, plans, and manages all facets of the HUD grants for Gwinnett County.

Much of the grant funding is then annually disbursed to other local partners and NGOs for programs.

Gwinnett appears to have a large affordable housing presence in Norcross, Lawrenceville, and Buford through several established “Housing Authorities”:

Gwinnett Housing Authority (GHA) - Established in 1997 as an NGO development organization primarily focused in the Norcross and Lawrenceville communities.

Lawrenceville Housing Authority (LHA) - A subsidiary of GHA according to their Secretary of State corporate filing. They are responsible for 10 housing sites with a total of 212 affordable housing units.

Buford Housing Authority (BHA) - Currently managing 186 units consisting of HCV (Section 8) public housing and low-income housing tax credit properties. The BHA serves Buford and the metro area.

GHA and LHA are primary in the county managing programs and receiving federal grant funding. In two years, we’ve noted GHA/LHA receiving:

$5,706,869 – HUD Grant Funds

$2,387,914 – American Rescue Plan Act (ARPA)

$61,638 – CDBG HUD Grant for Homeownership Center

$200,000 – CDBG HUD Grant for Pathway Rehabilitations

$400,000 – HOME Investment Grant for Affordable Housing

$500,000 – HOME Grant for Affordable Housing / Land Acquisition

$1.5 million – CHIP funds to construct 34 affordable homes

$1.3 million – HUD award to protect families from home health and safety hazards

In 2024, GHA purchased an extended-stay hotel for $8.7 million (March 2025) off Jimmy Carter Blvd in Peachtree Corners, with plans including renovations, security upgrades, and more to the 73-unit complex, estimated at an additional $14 million. Gwinnett County has committed $7.7 million in federal funding to support the effort. Units are to rent for $600–$1,200, aimed at homeless youth and seniors.

A full list of Gwinnett County HUD grant recipients totalling over $8.4 million in FY24, include:

(Note: Many of these NGO recipients were also identified as receiving additional federal grant funding through other Gwinnett County allocations in FY25.)

HUD guidelines also allow grant recipients to use 7.5% up to 20% of grant funds depending on program for “administrative costs,” including salaries/benefits, rent, utilities or maintenance, mission-related travel, planning, and more.

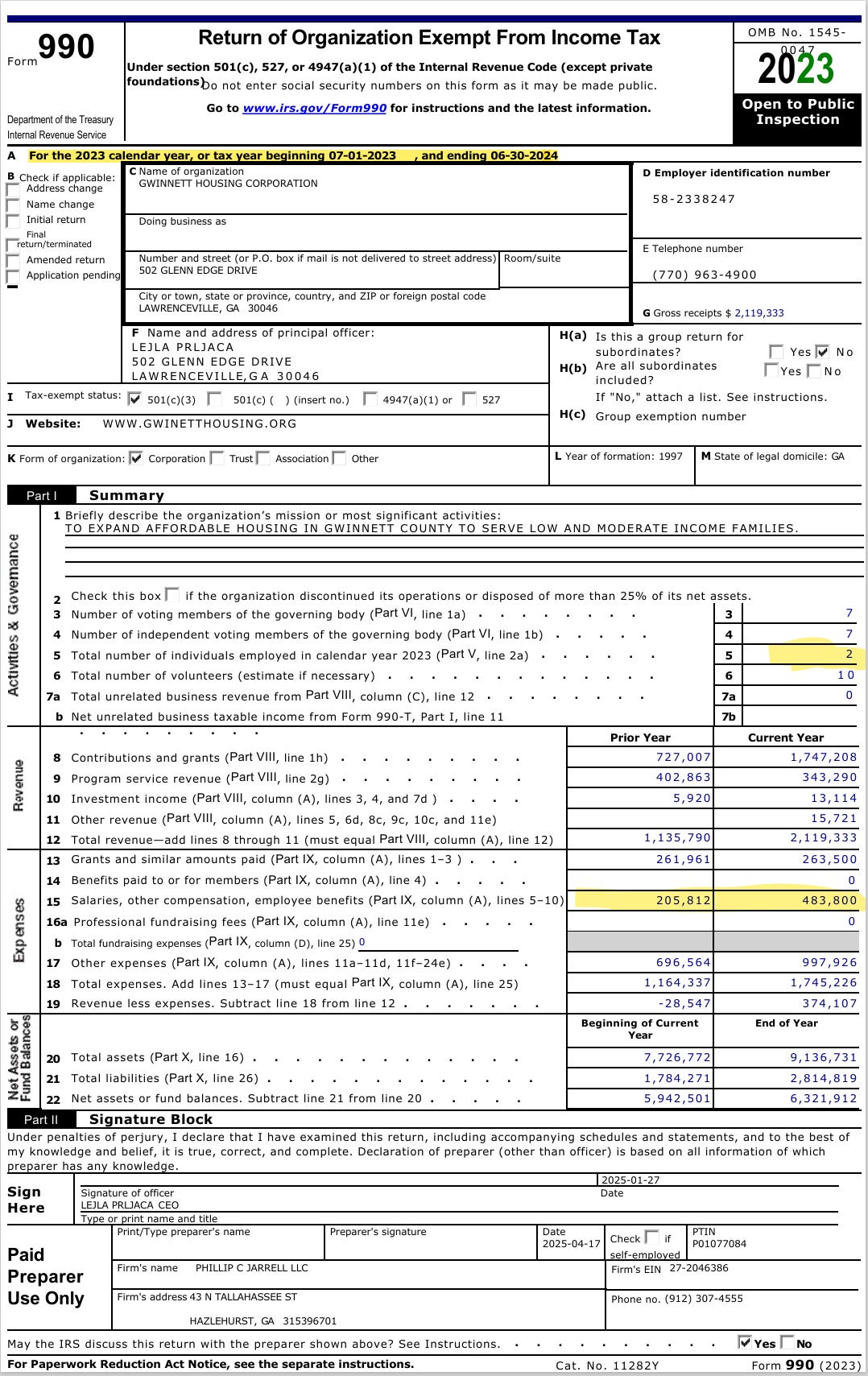

📑Below offers a quick review of the Gwinnett Housing Authority (Corporation) 990 IRS tax filing from 7/1/2023 - 6/30/2024. Although we are unclear of the reason or potential staff increases, it shows a noteworthy increase in salary/benefits of over 100% from prior year, though only two employees are listed on Line 5. We make no claims here to their filing, but offer the resource for review.

🔗To view the complete 990 IRS filing: READ HERE

Final Thoughts

Although we only touched on a few primary areas in this post—mainly Community-based Assistance and Tenant-based Assistance (Section 8)—there are many other programs under HUD or county-level administration that should be reviewed for transparency and accountability. We plan to continue research and bring highlights to the public.

We can all agree that those who are truly in need should have access and opportunity to guide them toward future independence—ultimately outside of the HUD system.

On a personal note, I found this process—like many government-run programs—to be bureaucratic, multi-layered, and unnecessarily complicated (even the HUD employee agreed). With so many pass-throughs, it’s easy to see how public distrust can arise—justified or not.

The future of HUD federal funding remains uncertain amid recent Executive Orders and proposed budget cuts for FY2026 currently under discussion. Potential changes could include stricter eligibility requirements for some programs, work requirements for able-bodied participants, and other structural adjustments. Notably, changes have already occurred at the Georgia HUD state office, where staffing has been reduced from 12 positions to just four through workforce cuts.

📣REMINDER:

ALL government spending—federal, state, and local—is YOUR TAX DOLLARS.

Open and fully transparent understanding and consent of its use should matter to everyone.

Thank you for reading Part 3 in this series. Feel free to share it with others who may be interested, and subscribe to receive future posts.

📚 Resources and Additional Reading:

Neilsberg Research: Gwinnett Income

U.S. Dept. of Labor: National Earnings

Frederal Reserve of St. Louis: Gwinnett County

Atlanta's Affordable Housing Trust Fund Raises Concerns

The Federal Funding Freeze and Its Impact in 2025

Housing Non-Profits Accused of Misusing Tax Funds

Gwinnett County: Homestretch Program

Gwinnett County HUD Consolidate Plan 2020-24

Disclaimer: This information is intended for educational and civic accountability purposes—to inform the public, encourage transparency, and ensure responsible governance in Gwinnett County. All information is true and accurate to the best of our knowledge and presented in good faith. Data has been obtained through publicly available sources or Open Record Request as of the date of publication.

So it's becoming more clear where the high density development is coming from. These programs guarantee the profitability (and the loans backing them up) for all these developments and assure that the landlords suffer no market risk. The Walmarts of the world are saved from having to pay the higher wages that a true market price for housing would entail. The Left gets to virtue signal their caring while at the same time benefitting from all the government and NGO money sloshing around. Thanks for providing at least an introductory primer into a very confusing subject.

Nothing about us poor property tax payers that endures increases to our assessments and annual tax bills, all for the board of education. We get no “assistance”.